In 2024, Pop Mart International delivered a stellar financial performance, propelled by its flagship IP Labubu—and this momentum continued into Q1 2025. Here’s a refined look at the numbers, the strategies behind them, and what it means for the future.

1️⃣ Stellar Financial Ramp-Up in 2024

Revenue & Profit Surge

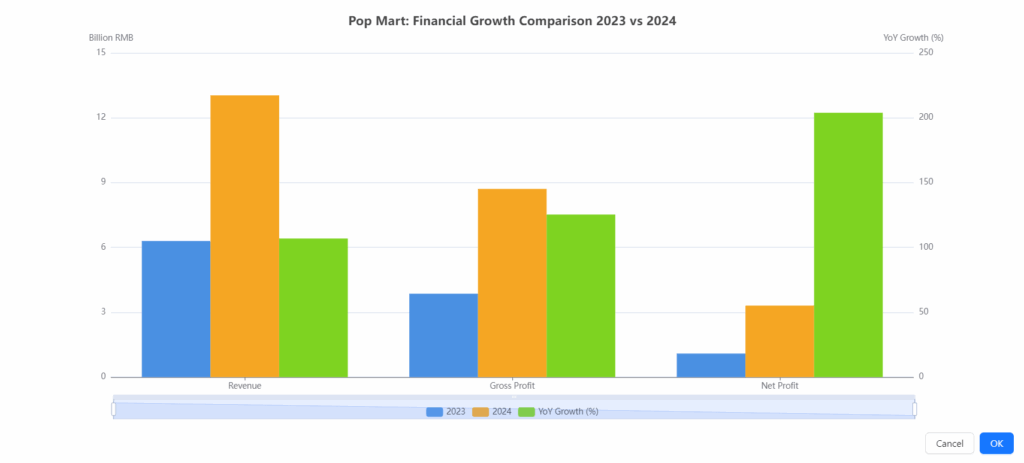

- 2024 total revenue reached RMB 13.038 billion—up 106.9% year-over-year from RMB 6.301 billion in 2023.

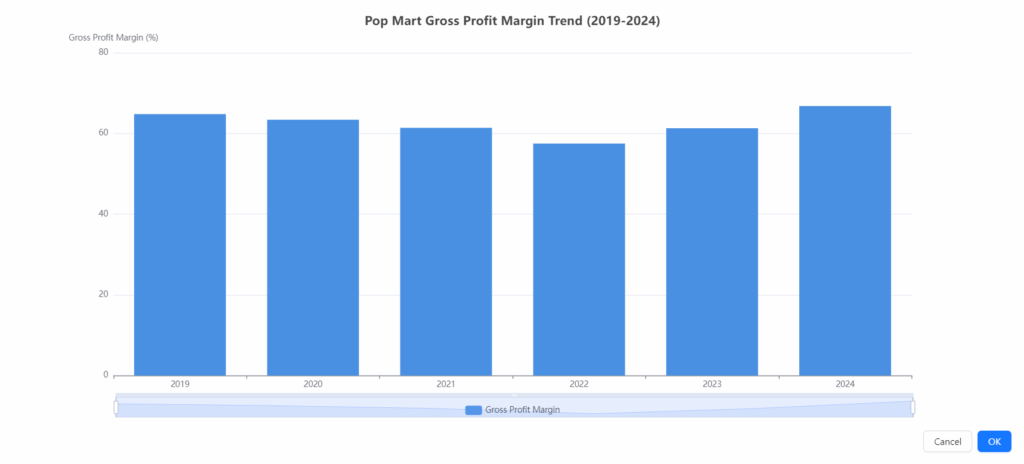

- Gross profit was RMB 8.708 billion (+125.4%), with gross margin climbing to 66.8% from 61.3%.

- Operating profit soared 237.6% to RMB 4.154 billion, while net profit jumped 203.9% to RMB 3.308 billion (adjusted net profit RMB 3.400 billion; adjusted margin: 26.1%)

Agent: ai-bar-graph-generator

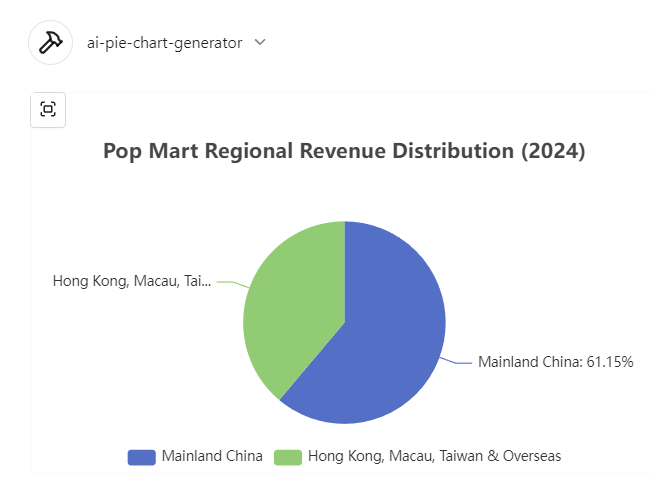

Regional Revenue Balance

- Mainland China delivered RMB 7.972 billion (+52.3%), accounting for 61.1% of total revenue.

- Overseas (including HK, Macau, Taiwan) revenue exploded +375.2% to RMB 5.066 billion (38.9%) .

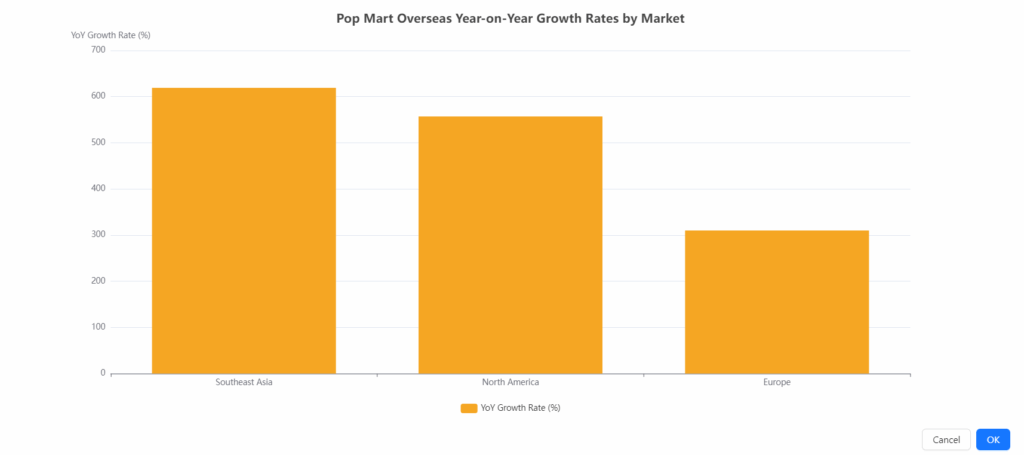

- Southeast Asia (+619%), North America (+557%), Europe & Oceania (+310%) were key drivers globenewswire.com.

Agent: ai-pie-chart-generator

? Takeaway: Pop Mart successfully diversified from domestic to global markets, improving profitability and scaling IP monetization.

2️⃣ Labubu: The Money-Making Monster IP

Labubu’s Domination

- The Monster series—led by Labubu—generated RMB 3.041 billion in revenue (+726.6%), making it the top IP (23.3% of total revenue) ainvest.com+8globenewswire.com+8en.wikipedia.org+8.

- By comparison, Molly, Skullpanda, and Crybaby earned RMB 2.093 billion, RMB 1.308 billion, and RMB 1.165 billion respectively en.wikipedia.org.

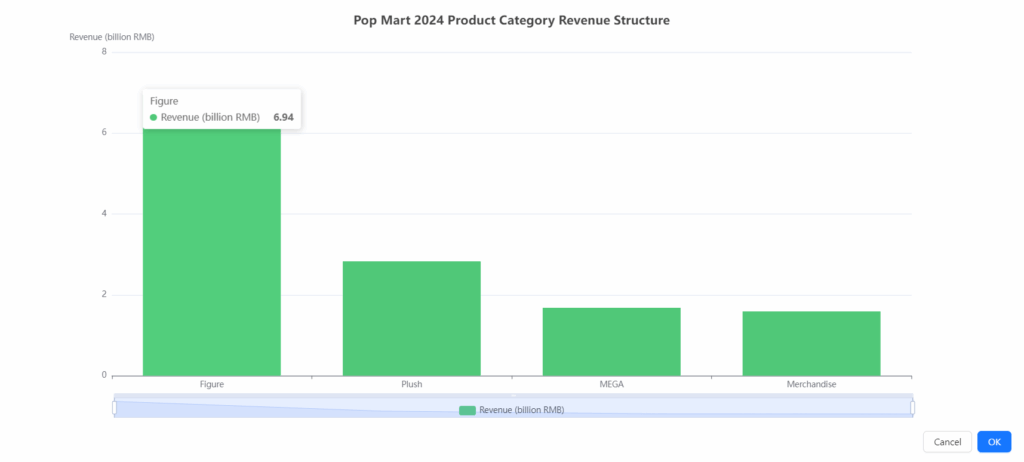

Category-wide Expansion

- Figure revenue: RMB 6.94 billion (+44.7%).

- Plush surged — RMB 2.83 billion, up a staggering 1,289%, now 21.7% of revenue.

- MEGA series added RMB 1.68 billion (+146%). Derivatives and extras contributed RMB 1.59 billion (+156%) ainvest.com.

Agent: ai-bar-graph-generator

? Insight: Labubu’s design appeal and scarcity model drove outstanding monetization. The IP-centric strategy allowed Pop Mart to rapidly scale across product lines.

3️⃣ Q1 2025: Continued Expansion & Market Breakthrough

Explosive Q1 Growth

- Revenue spiked 165–170% YoY, driven by continued global and domestic momentum

- China revenue: +95–100%; Overseas: +475–480%

Global Market Breakdown (YoY Growth):

- APAC region: +345–350%

- Americas: +895–900%

- Europe: +600–605%

Agent : Chart maker

In the U.S., revenue nearly matched 2024 total in Q1 alone, with 26 stores and 1.7 million members .

? Insight: Pop Mart’s overseas expansion—especially into the Americas—is accelerating at a breakneck pace.

4️⃣ Leadership in a Competitive Landscape

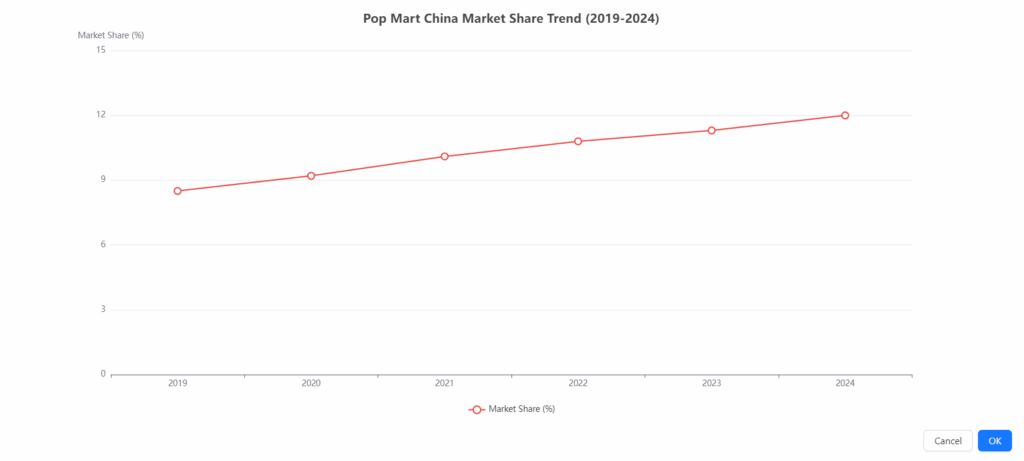

Market Share & Consumer Loyalty

- Pop Mart holds ~12% of China’s trendy collectibles market, up from ~8.5% in 2019 facebook.com+2en.wikipedia.org+2globenewswire.com+2.

- As of 2024, 46.08 million mainland members contributed to 92.7% of sales, with a retention rate of 49.4% .

Core Advantages:

- End-to-end IP incubation → multi-category expansion

- Robust global retail footprint (flagship stores + vending machines)

- Loyal fanbase: content creation, UGC, resale culture

Macro Tailwinds: China’s collectible toy market projected to hit RMB 110 billion by 2026 (CAGR 20%) moomoo.com+9globenewswire.com+9technode.com+9.

5️⃣ Risks & Challenges Ahead

Despite impressive growth, challenges remain:

- Stiffening Competition: New players (e.g., TopToy by Miniso) are expanding aggressively—276 stores and ~RMB 9.8 billion revenue in 2024 moomoo.com+2technode.com+2tipranks.com+2globenewswire.com.

- Overreliance on Key IPs: Labubu and Monster series contributing a notable chunk. Maintaining relevance across newer IP lines will be essential.

- Valuation Volatility: Early backers cashing out ($100m+ in 2023–25) could impact investor confidence globenewswire.com+1en.wikipedia.org+1.

- Global Market Adaptation: Scaling overseas requires A) cultural relevance, B) logistic scaling, C) supply chain resilience.

✅ Final Analysis: What It All Means

Pop Mart’s 2024 and Q1 2025 performance underlines its transformation from “novelty toy maker” to global IP powerhouse. The rapid rise of Labubu not only highlights the effectiveness of scarcity mechanics + emotionally resonant design, but also proves the strength of a mature IP ecosystem.

Looking ahead:

- Diversification across IP and product categories will be critical.

- Sustained overseas growth must navigate local consumer preferences and cost structure.

- Investment in new IP, global storytelling, and supply chain scalability will define Pop Mart’s ability to sustain momentum.

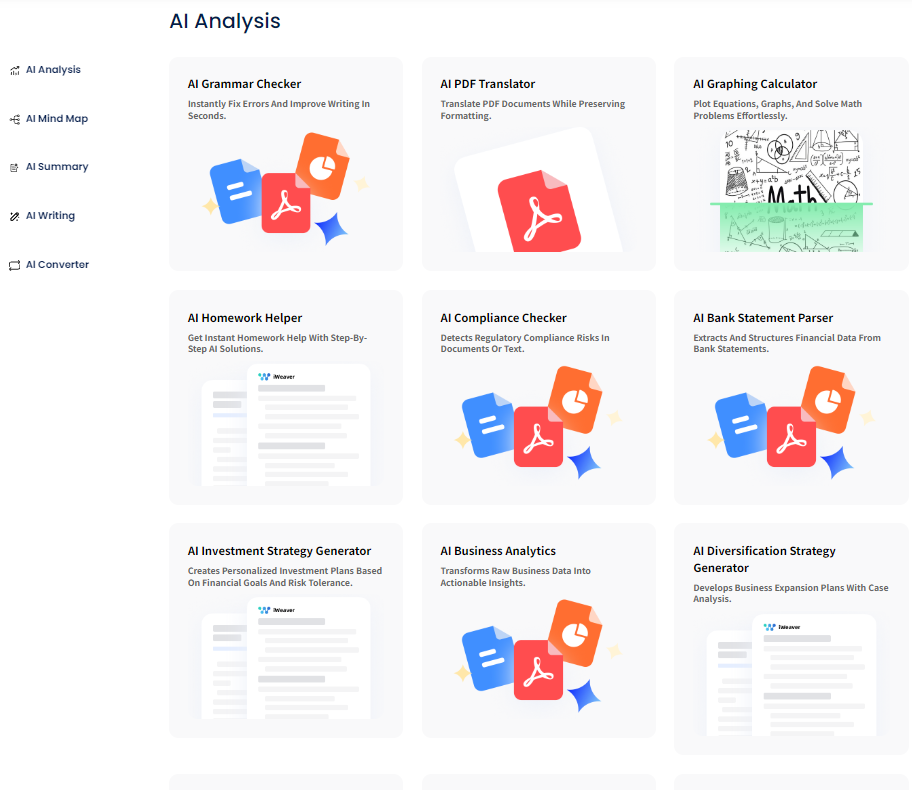

? Tailored Insights for iWeaver Users

- Use AI Financial Analysis tools to benchmark rapid-growth IP-driven companies.

- Deploy sentiment analysis to catch cultural signals behind new collectible hypes.

- Track regional performance metrics across global expansions using public data.

By applying rigorous analysis and strategy—just like Pop Mart did with Labubu—you can calibrate your own viral IP strategy, backed by data and creativity.

If you’d like help turning this analysis into visuals, a pitch deck, or integrating AI tools like iWeaver to replicate the process—just say the word!